| Capital: | € 55 million |

| Age: | 44 |

| Born: | 10/28/1975 |

| Country of origin: | Austria |

| Source of wealth: | Entrepreneurs |

| Last updated: | 2022 |

Brief introduction

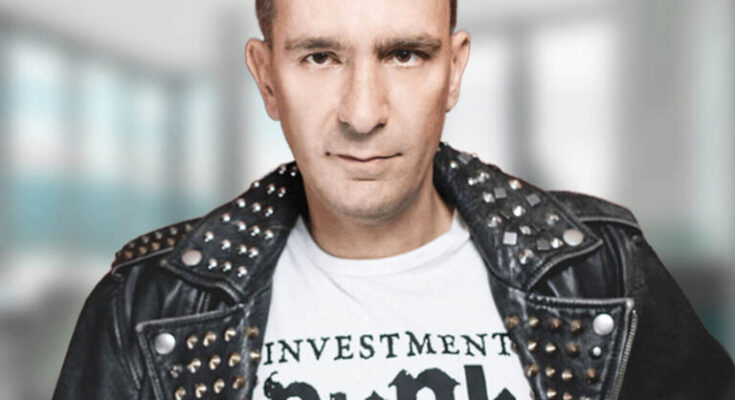

Gerald Hörhan, born on October 28, 1975 in Vienna, is an investor from Austria. As a graduate of the Mathematics and Statistics route at Harvard, he’s acknowledged as “Investment Punk”.

Early life

He have become acknowledged for his first ee-e book Investment Punk, a bestseller in Germany and Austria. Hörhan could be very frequently a visitor of German and Austrian tv programs, wherein he explains the way to make investments your cash and grow to be a multimillionaire. His rebellious photo and information make him an abnormal person. Before he became 30, he have become a millionaire and owns greater than 2 hundred houses in the biggest towns in Germany, however additionally in Vienna in Austria. Hörhan finished the Phi Beta Kappa route in 1997 and studied at Harvard in 1998, wherein he studied arithmetic and records earlier than receiving his degree with very honorable mention.

Career

He labored for 12 months as an funding banker at JPMorgan Chase & Co. in New York and as a control representative at McKinsey & Co. in Frankfurt am Main. He cautioned numerous corporations together with Goldentime at the IPO. He additionally controlled the worldwide organisation Pallas Capital in Vienna. Gerald Hörhan additionally labored on Wall Street, wherein he performed a complete transaction of 1 billion euros. His ee-e book Investment Punk made him acknowledged to the German and Austrian audience. Hörhan has been a visitor on numerous tv systems considering that 2010: as an instance on SWR, on NDR / Radio Bremen or on ZDF with Peter Hahne. From 2011 he taught on the monetary college with Harald Psaridis. On January 31, 2013, withinside the very famous Galileo application in Germany, he became given a complete record on “How to Get Rich Despite the Crisis”.

He looks after his punk appearance and provocative style, which could be very uncommon for someone with any such degree of obligation and education. Hörhan additionally based his very own college, “Investment Punk Academy”, wherein he teaches contributors the way to get rich. For Hörhan, the center instructions are the most important losers in financial development. Average profits personnel eat thru money owed that cause ruin. This development, which became first acknowledged withinside the USA, became observed via way of means of Austria and Germany. This fashion brought about the 2007 crisis.

He explains his conviction in a totally provocative manner that humans lack financial training. According to him, younger humans examine history, poetry and artwork and forget finances, which dangers them and does now no longer permit them monetary independence: as an instance to stay from passive profits.

Gerald Hörhan is an impartial funding banker and has been the proprietor and coping with director of the Danube Advisory Group considering that 2003. Previously, he labored as a statistical assistant at Harvard University. Gerald Hörhan became additionally a representative at Monitor, a merger and acquisition analyst at JP Morgan New York and a representative for company finance tasks at MCKinsey & Co. Frankfurt in addition to a companion and co-proprietor of the Qino Group London / Zug-CH / Vienna and a companion in a Swiss personal fairness Funds.

Gerald Hörhan additionally fulfills many different crucial functions. Among different things, he’s co-proprietor and member of the Board of Directors of Holding Pallas Capital AG, member of the supervisory board and constituent board of numerous corporations, co-proprietor of certainly considered one among the biggest ee-e book publishers in Austria and actual property investor in Germany. At the Math Olympiads, he received gold in Austria and silver worldwide. Gerald Hörhan has additionally posted numerous courses in German and English. Mr. Hörhan additionally offers lectures on the Vienna University of Economics and Business, on the Institute for Entrepreneurship and Innovation and on the German Academic Foundation.

Career highlights

Hörhan obtained a bad reaction in a assessment via way of means of the Frankfurter Allgemeine Zeitung, wherein writer Philippe Kron wrote that the understanding of his ee-e book may be saved in a ten-web page folder. In his very last assessment, he referred to as Herkhan’s paintings a ee-e book for masochists. Kristof Kapalschinski, a reviewer of the Handelsblatt, shows that the reader of the ee-e book hopes to grow to be a sufferer of satire. In his opinion, the ee-e book is much less offensive to the center magnificence than to the intelligentsia. The response withinside the Austrian media became milder. The each day newspaper “Die Presse” interviewed the writer substantially at the theses of his ee-e book. In the Wiener Zeitung, Christian Ortner defined Hörhan’s 2d ee-e book “Gegengift” as an without problems understandable, extraordinarily beneficial ee-e book, in particular for economically unknown readers. The recommendation became credible and trustworthy, despite the fact that the ee-e book became written in a darkish style.

For his modern day publication, Hörhan became searching out new allies, particularly the Austrian Economic Center, that’s presently vastly selling his ee-e book Null Bock. Franz Wolf Wolfart, General Director of Novomatic, is a member of the Scientific Council of the Liberal Think Tank. This is an offshoot of Frederick A. v. Hayek Institute. Barbara Colm, former guide to the FPÖ in Innsbruck, is an vital a part of this “institution”. Of route Herkhan has tailored the “message” of his new ee-e book to what his pals in enterprise want to hear: “At the instant we’ve got a totally uncommon redistribution: from“ hard-running to lazy ”and from“ terrible hard-running ”to“ badly lazy ”. This is risky due to the fact productiveness is now no longer rewarded.