Introduction

Cryptocurrency transactions, in addition to their high profitability, have a very high risk, and this is why people who intend to trade in this market, before allocating their capital, get complete information about this area and without information do not get involved. Fearless investors, on the other hand, who feel that the sharp fluctuations of the cryptocurrency market are not exciting enough, have the ability to take advantage of the margin trading offered by many digital exchanges these days.

Leverage margin trading, while bringing a lot of profits to individuals, can also cause persons to lose all of their capital. Therefore, a number of digital exchanges expect more from margin traders and are more rigorous in their authentication process.

In this article, we intend to take a full look at the concept of margin trading and the form of such transactions in the cryptocurrency market. So we invited Mohammad Hosseini to answer various questions about this during an interview.

Mohammad Hosseini is one of the young entrepreneurs who was born in July 1996 in Tehran. He is an expert in the fields of stock exchanges and cryptocurrencies and has a master’s degree in mechanical engineering. After getting acquainted with the stock market and many successes he achieved in this market, he entered the field of cryptocurrencies in 2015 as a Bitcoiner and a trader.

What is Margin Trading?

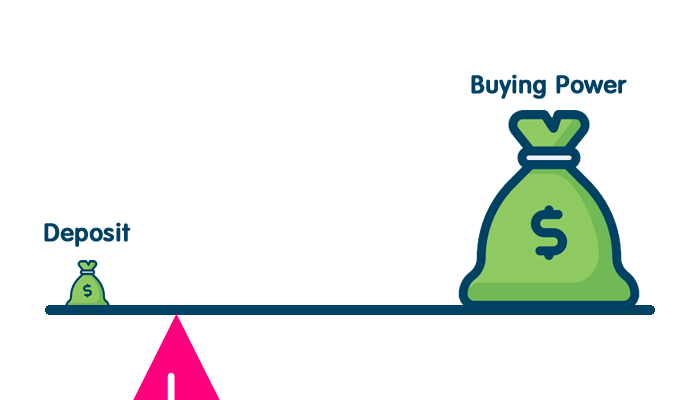

Margin trading is an activity in which an amount of surplus capital is borrowed by leveraging the current balance to enable a person to trade with higher capital. Hence, margin trading is also called leverage trading. This trading method is an old method that is also used in traditional financial markets.

The concept was initially used in the US financial markets and has now been implemented in several international exchanges as well as in the cryptocurrency market. In general, there are many rules for margin trading in financial markets, but in the cryptocurrency market, simpler rules are defined for such transactions. Nevertheless, the basis of margin trading is the same, both in the stock and securities markets and in the cryptocurrency market.

The question that has probably arisen for you is who in the trading margin is willing to lend the surplus amount to the trader for trades? In fact, most of the time, they are lenders, brokers, or trading platforms that give their capital to traders in exchange for commissions and interest.

On the other hand, in the cryptocurrency and Forex markets, when an asset purchased by a trader falls in price and reaches a level where the capital lent to the trader is in danger of being destroyed, his trading position is automatically taken by the broker or bridge, and transactions will be closed. In this way, the broker or trading platform prevents the loss of the borrowed asset and avoids its commission.

Furthermore, when a trader makes profitable trades, the broker’s fee or trading platform will be deducted from the trader’s profit in a timely manner. So, in either case, the trading platform or broker will get their money’s worth.

How does margin trading work?

In Forex and stock markets, the borrowed capital is usually secured by a trader, a broker, or an intermediary. But in the cryptocurrency market, such capital is usually provided by other traders. For example, all the capital that Binance Exchange lends to its margin market traders is provided by other traders.

The concept of Leverage in the trading margin

In margin trading, traders use leverage to determine how much capital they intend to borrow. For example, if a trader uses Leverage 2, it means that he intends to double his capital, half of which will be provided by the trader himself and the other half will be lent to him by an exchange.

The range of leverage in margin trading is different in each digital exchange and depends on the policies adopted by that exchange and the amount of liquidity available in it. Apart from this, note that the lever is displayed in two forms, which are the lever 2x or 2: 1 (two to one) in which the trader’s capital is doubled and the leverage 50x or 50: 1 (fifty to one) in which the trader’s capital is It increases 50 times and one-fifth of this amount is provided by the trader himself.

What is margin account?

In financial markets, we have two types of accounts, which are Spot accounts and Margin accounts. In Spot accounts, all the capital in the account is provided by the trader, but if he borrows money from an exchange, his account becomes a margin account. On the other hand, as you may have guessed, a margin account is an account in which an amount of assets in a trader’s account is lent to him by an exchange. Apart from these, in order to operate in the margin market, the margin account must be used, and it is not possible to trade in the margin market using the Spot account.

What is liquid or margin price?

Liquidation or margin calling in margin trading and futures trading is a topic that is considered as a nightmare for traders. Liquidation actually means zeroing the balance of the trader’s trading account and destroying all his capital in the margin account. Imagine that a trader has $ 2,000 in his Spot account and buys an ETH coin at that price. But, his capital will be zero when the price of Kevin Ethereum is zero in the market. In other words, the trader here has an Ether and the Ether price in the market is zero, which means that his capital has been destroyed.

Now imagine that a trader has $ 500 in his Spot account and certainly cannot buy an ETH with this figure, but enters the trading margin after increasing his profit. He quadruples his fortune through a leverage of 4 and now has $ 2,000 in his account, of which $ 500 is his own capital and the rest has been lent to him by an exchange office. On the other hand, the exchange does not share in the profit and loss of a trader and lends him only a sum of money, and apart from the fact that the price of Ethereum decreases or increases, it receives the same amount from him along with a specific fee.

What are margin trading platforms?

In the cryptocurrency market, there are various trading platforms that provide leverage or margin trading capabilities for its users, the best of which are BitMex, Huobi, Whaleclub, Kraken, Binance, etc.

What are disadvantages of trading margin?

As mentioned above, margin trading is very risky, and this is the first disadvantage of margin trading. In fact, if you are planning to do margin trading in a market such as the cryptocurrency market, you will need much more risk-taking. Because currency market fluctuations are very high and margin traders must be very careful and vigilant. On the other hand, among the other disadvantages of margin trading, we can mention the time when the trader is called margin and is on the verge of losing part or all of his capital.

In margin trading, it is possible to lose an amount even more than the initial capital of the individual trader and he owes money to an exchange, so to do margin trading, the trader needs a very high skill in cryptocurrency market analysis. It has currencies to be able to predict the future market conditions well.

What are common terms in margin trading?

To operate in the margin trading market, we first need to become familiar with terms that are very common. So far, we have come to terms with the terms margin, margin call and a few other important terms. We are going to mention some other common terms in the field of margin trading in the following section.

Total Balance

Total Balance or Margin represents the total capital of a trader. In fact, this figure includes the original capital of the trader and the figure lent to him by an exchange.

Total Debt

This figure is the amount of money that the exchange has lent to the trader.

Account Equity

This term actually indicates the value of the trader account and is obtained by deducting Total Debt from Total Balance.

Concluding remarks

Margin trading is basically a platform for people who are looking to increase their profits in financial market transactions, especially the digital currency market. In fact, in this market, if traded properly, the profit of the trader will be multiplied. On the other hand, margin trading digital currencies has a very high risk and it is possible that the trader will lose all his capital and owe some money to the exchange.

Summary: In general, margin trading is described as the way in which a certain amount of assets can be borrowed from a broker or trading platform to invest in a larger volume and through which to enter into more profitable trades. Join us to learn more about margin trading and its terms.

Reference:

https://academy.binance.com/en/articles/what-is-margin-trading

https://medium.com/coinmonks/the-most-simple-guide-to-cryptocurrency-margin-trading-69f7fafb1960